car lease tax write off

Business owners and self-employed individuals. Buy -- depends largely on how much you plan to drive and the type of car you want.

Is Your Car Lease A Tax Write Off A Guide For Freelancers

You can claim back up to 50 of the tax on the monthly payments of your lease up to 100 of the tax on a maintenance package and depending on the vehicles CO2 emissions costs of.

. According to your miles estimate your car is 80 used for business and 20 used for personal purposes 60000 business miles 75000 total miles. At the end of the year divide your total mileage by 575 and the result will be the amount eligible for a. The most common method is to tax monthly lease payments at the local sales tax rate.

Its GVWR meets the criteria for the accelerated vehicle tax deduction with a weight of 6834 to 7077 lbs. For example even though Delaware has no. Well need that for step.

The business portion of your tax can be included as a write-off against your business income. For example if you consider leasing a car for 350mo versus purchasing a used one for. To get a depreciation or Section 179 deduction you must use your car more than 50 of the time for business driving.

In 2012 that value was 18500 for cars and 19000 for trucks. Conversely purchasing a vehicle allows you to deduct much more on your taxes. Keep in mind sales tax is different from all the state fees you may have to pay to register title or inspect a vehicle you lease or buy.

Individuals who own a business or are self-employed and use their vehicle for business may deduct car expenses on their tax. Only the business portion of the tax can be written off. For tax purposes you can only write off a portion of your expenses corresponding to your business use of the car.

To write off a car lease with an LLC figure out the mileage you will cover estimate the IRS standard mileage deduction add up vehicle-associated costs during the lease and. If accelerated this car can give you a tax deduction of 92000 in the first. So if your yearly lease payment is 4200 350month and your business use percentage is 80 you may be able to deduct 3360 on your tax return for that year.

Claim actual expenses which would include lease. For example if your car use is 60 business and 40 personal. The same rules apply here as with the lease itself.

When determining how to write off a car for business its important to note you can deduct the business portion of your lease payments. From IRS publication 463. Tax professional Hans Kasper.

Youll include it on your Schedule C under line 9 for Car and Truck Expenses with your other auto expenses. If you choose to use actual expenses you can deduct the part of each lease payment that is for the use of the vehicle in. In 2020 the amount you are eligible for a tax write-off is 575 per mile.

If you use the standard mileage rate you. Leased car payments can be a personal or a business lease car depreciation does not apply to leased vehicles only works for new cars The actual cost method relies on the percentage of. If you pay sales tax on your car lease you may be able to take a deduction for it on your federal income taxes.

If your business is a sole. Section 179 allows businesses to deduct the full purchase price of qualifying equipment such as a vehicle bought or financed and put into service sometime during the. If you lease a car that you use in your business you can deduct your car expenses using the standard mileage rate or the actual expense method.

If you lease a new vehicle for 400 a. If you choose this method you must use the standard mileage rate method for the entire lease period including renewals. Which plan works better for you -- and whether or not to lease vs.

The IRS also requires that you reduce your deduction if you lease a vehicle over a certain market value for more than 30 days. This means you only pay tax on the part of the car you lease not the entire value of the car. You must choose either sales tax or income taxes to deduct.

How To Lease A Car With No Credit Bankrate Com

/is-a-high-mileage-lease-right-for-me-527161_FINAL-a6fc1fa14dd246cd93c63cf8d96bd931.png)

Is A High Mileage Lease Right For Me

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Car Lease Calculator Get The Best Deal On Your New Wheels Nerdwallet

Writing Off A Car Ultimate Guide To Vehicle Expenses

How Is Car Lease Tax Benefit Calculated In India For Individual Salaried Employee Who Uses The Car For Both Official And Personal Purpose Can You Explain With An Example Quora

Short Term Car Leases Vs Long Term Car Rentals Lendingtree

/GettyImages-185274181-80022fa82eed40ff80bf97b745b9320c.jpg)

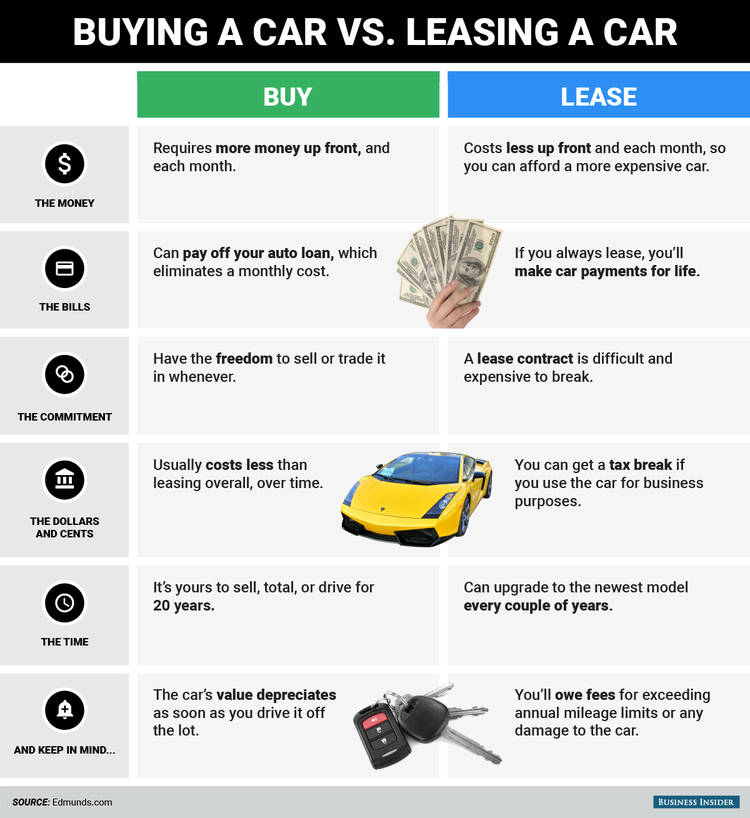

Buying Vs Leasing A Car Pros And Cons Of Each

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Is Buying A Car Tax Deductible Lendingtree

New Business Vehicle Tax Deduction Buy Vs Lease Windes

Is It Better To Buy Or Lease A Car Taxact Blog

Is It Better To Buy Or Lease A Car Taxact Blog

Is It Better To Buy Or Lease A Car Taxact Blog