deferred sales trust pros and cons

A section 7702 Plan is simply referring to cash value life insurance and the many tax benefits it receives under the Code. This is why most experts advise a holistic financial plan and a diverse investment portfolio.

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Some of the advantages of life insurance are tax deferred growth tax free policy loans and a tax free death benefit.

. Everything Investors Should Know About Delaware Statutory Trusts. Delay selling your home to pay for care. Ubiquity a leading 401k provider explains.

Standard benefits packages with medical 401K and two weeks vacation are quickly becoming overshadowed by more diverse unique and. Billing in arrearsalso known as deferred paymentmight be better suited to your business operations. The amortizing option provides a 30-year second mortgage loan for 6 of the purchase price that is serviced by monthly payments at an interest rate equal to the first mortgage.

While you may feel inclined to trust growth projections in the annuity sales materials your advisor initially showed you sales materials may not tell you the whole story. Investing in real estate can provide many advantages. In this way billing in arrears is an easier way to build trust with your clients.

You CAN designate a trust as the beneficiary of 401k plan assets but there are pros and cons to consider. If you cant afford care home fees and dont want to sell your home or are finding it difficult to do so a deferred payment agreement may be a useful option. Consider a rollover.

If youre like most American workers youll have at least 10 different jobs before the age of 40 1 and multiple jobs may mean multiple retirement accounts which can be challenging to manage. We pride ourselves on partnering with professionals like those from Senior Market Sales SMS a market leader with over 30 years of experience in the insurance industry who offer personalized retirement solutions for consumers across the country. Trying to estimate the future value of an annuity can feel overwhelming.

However you also have to put trust in clients to pay their bill. Offering competitive benefit packages has become increasingly important for organizations looking to add top-performers to their team. Income share agreement Established in 2012 App.

In todays market its becoming more difficult to attract and retain top talent. Employers can prohibit trusts from receiving periodic 401k payouts meaning all the deferred taxes will be due on the full 401k balance within one year of your. A 1031 exchange is a tax break.

The Internal Revenue Code has several section devoted to life insurance including section 7702. What may be considered an advantage for a 52-year-old in a high tax bracket and nearing retirement may be a disadvantage for a 35-year-old with a high. If you understand the cons annuities.

Youll want legal guidance which raises the cost of a living trust compared with a basic will. A generic list of pros and cons for every other type of investment would cover the same concerns. REIT investing can be a good addition to a diversified portfolio.

Annuities are complex products so figuring out how much yours will be worth may take some work. A deferred payment agreement is a long-term loan you can request from your local authority if you own your home. The deferred option provides a 6000 interest-free loan that is forgivable after 30 years as long as the home is not refinanced or sold.

Pros and cons of advance payments. Online full- or part-time. Using leverage to increase potential returns and risk accordingly combined with tax advantages such as depreciation and deferring capital gains taxes through 1031 like-kind exchanges have long made real estate an attractive option for savvy investors.

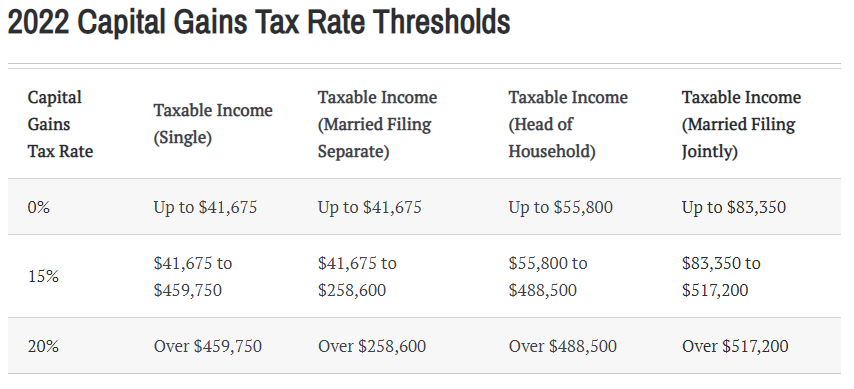

You can sell a property held for business or investment purposes and swap it for a new one that you purchase for the same purpose allowing you to defer capital. Learn about 5 types of REITs and the pros and cons to make a smart investment decision. You have several options available to.

If the transfers go wrong your trust becomes a useless piece of. A 401k retirement plan is a type of retirement account that allows employees to contribute a defined amount of pretax or Roth after tax dollars each pay period. Unlike a deferred annuity.

That includes the deed to your house your bank and investment accounts usually excluding tax-deferred retirement accounts valuable personal property and any new assets you acquire. Employers also have the opportunity to match part or all of the employees tax-deferred retirement contributions or provide a profit sharing contribution although those contributions are not required.

Advanced Planning Deferred Sales Trusts The Quantum Group

The Pros And Cons Of Deferred Revenue Saas Metrics

Pros And Cons Of Investing In A Delaware Statutory Trust

Employee Ownership Trusts The Pros And Cons

91 How To Defer Capital Gains With The Deferred Sales Trust With Brett Swarts Everything Real Estate Investing

Deferred Sales Trust The 1031 Exchange Alternative

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

What Are The Differences Between A Deferred Sales Trust Dst And A Charitable Remainder Trust Crt Ameriestate

Deferred Sales Trust The Other Dst

Deferred Sales Trust The 1031 Exchange Alternative

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Deferred Sales Trust For Ria Youtube

Pros And Cons Of The Deferred Sales Trust Reef Point Llc

Five Ways To Defer Your Capital Gains Taxes Re Viv

Deferred Sales Trust Oklahoma Bar Association

Deferred Sales Trust The 1031 Exchange Alternative