ri tax rates by city

There was no increase in our tax rates from last year the tax rates remain. Welcome to the city of Central Falls Rhode Island.

Top 5 Highest Lowest Property Tax Rates By Town In Rhode Island Youtube

1 to 5 unit family dwelling.

. Middletown RI Sales Tax Rate. 2018 Tax Rates 392 KB Tax. The tax rates for the 2022-2023 fiscal year are as follows.

State of Rhode Island Division of Municipal Finance Department of Revenue. By law you are required to change. The current tax rates and exemptions for real estate motor vehicle and tangible property.

2022 List of Rhode Island Local Sales Tax Rates. 2022 Tax Rates assessed 12312021. Rhode Island has a.

FY2023 starts July 1 2022 and ends June 30 2023. 2022 Tax Rates. The Rhode Island RI state sales tax rate is currently 7.

Rates include state county and city taxes. About Toggle child menu. Providence Rhode Island 02903.

Tax Rates Exemptions. 401 728-0500 Tax Assessors Fax. The latest sales tax rates for cities in Rhode Island RI state.

City Hall Main Number. 2020 rates included for use while preparing your income tax deduction. Lowest sales tax 7 Highest sales tax 7 Rhode Island Sales Tax.

Adamsville RI Sales Tax Rate. Central Falls has a property tax rate of. Rhode Island has state sales.

Look up 2021 Rhode Island sales tax rates in an easy to navigate table listed by county and city. Less than 100000 use the Rhode Island Tax Table located on pages T-2. Average Sales Tax With Local.

The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income. Community Residents Visitors. Vehicles registered in Newport RI are taxed for the PREVIOUS calendar year ie.

City ClerkRecords. 3243 - commercial I and II industrial commind. Free sales tax calculator tool to estimate total amounts.

West Greenwich has a property tax rate of 2403. 41 rows West Warwick taxes real property at four distinct rates. The tax rates for the 2022-2023 fiscal year are as follows.

The tax rates for the 2022-2023 fiscal year are as follows. Rhode Island has a graduated individual income tax with rates ranging from 375 percent to 599 percent. City Total Sales Tax Rate.

By law you are required to change. The latest sales tax rates for cities in Rhode Island RI state. FY2023 Tax Rates for Warwick Rhode Island.

Pawtucket City Hall Tax Assessors Office - Room 109 137 Roosevelt Avenue Pawtucket RI 02860. Rhode Island Towns with the Highest Property Tax Rates. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three.

City of Woonsocket 169 Main Street Woonsocket RI 02895 401 762-6400. The tax rates for the 2022-2023 fiscal year are as follows. 1851 for every 1000.

Providence has a property tax rate of 2456. 2989 - two to five family residences. 2019 tax bills are for vehicles registered during the 2018 calendar year.

Rhode Island also has a 700 percent corporate income tax rate.

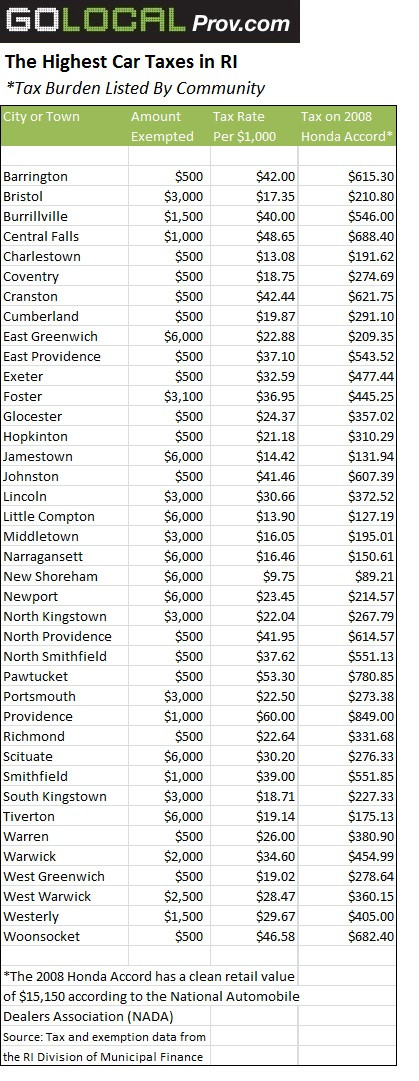

Golocalprov The Highest Car Taxes In Ri For 2013

De Blasio S Awful Tax Hike Timing Empire Center For Public Policy

Cities With The Highest Tax Rates Turbotax Tax Tips Videos

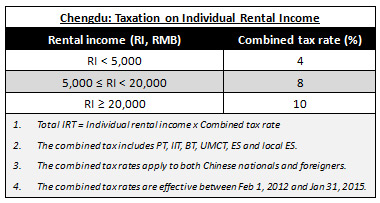

Taxation On Real Estate Rental Income In China China Briefing News

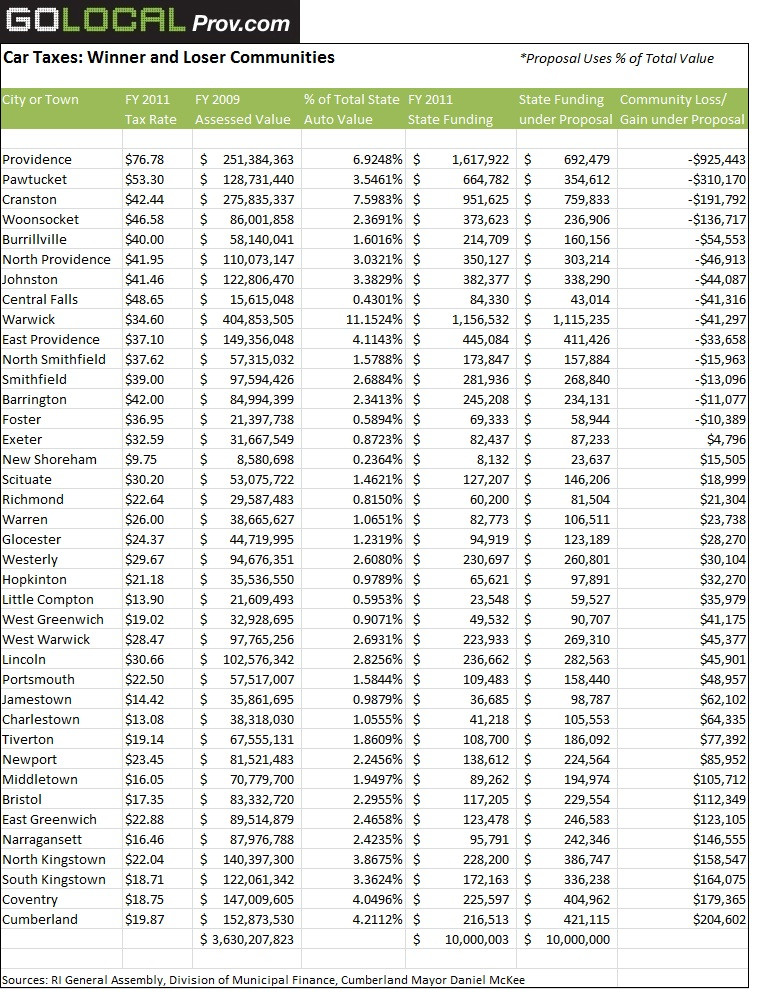

Golocalprov Half Of Ri Taxpayers Lose Out On Car Tax Money

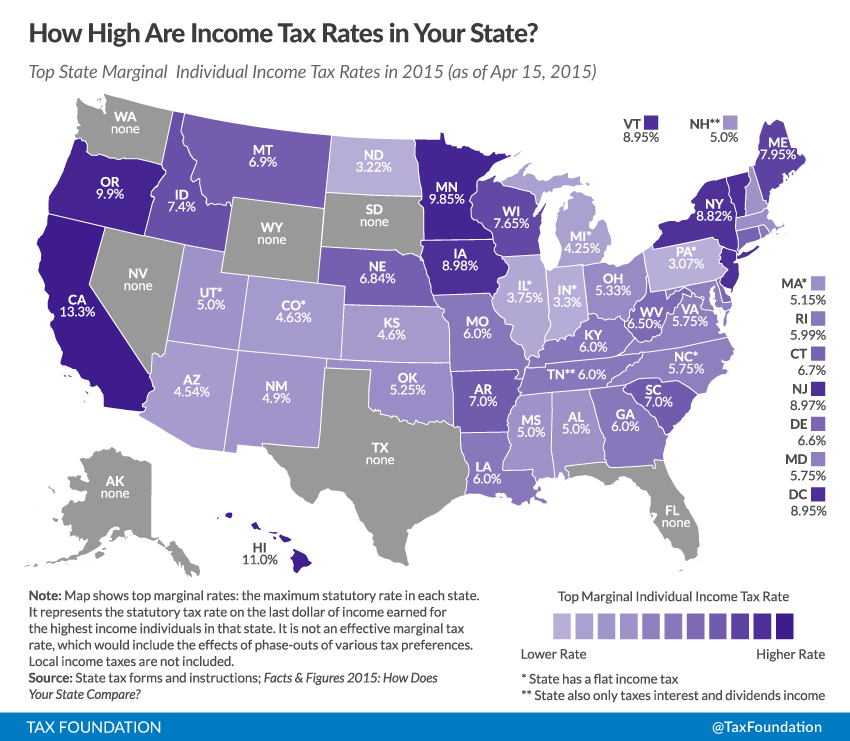

States With The Highest Lowest Tax Rates

State Income Tax Rates And Brackets 2021 Tax Foundation

Glocester Ri Official Town Web Site

Rhode Island Income Tax Ri State Tax Calculator Community Tax

39 Ri Real Estate Tax Rates By Town Ideas Estate Tax Rhode Island Towns

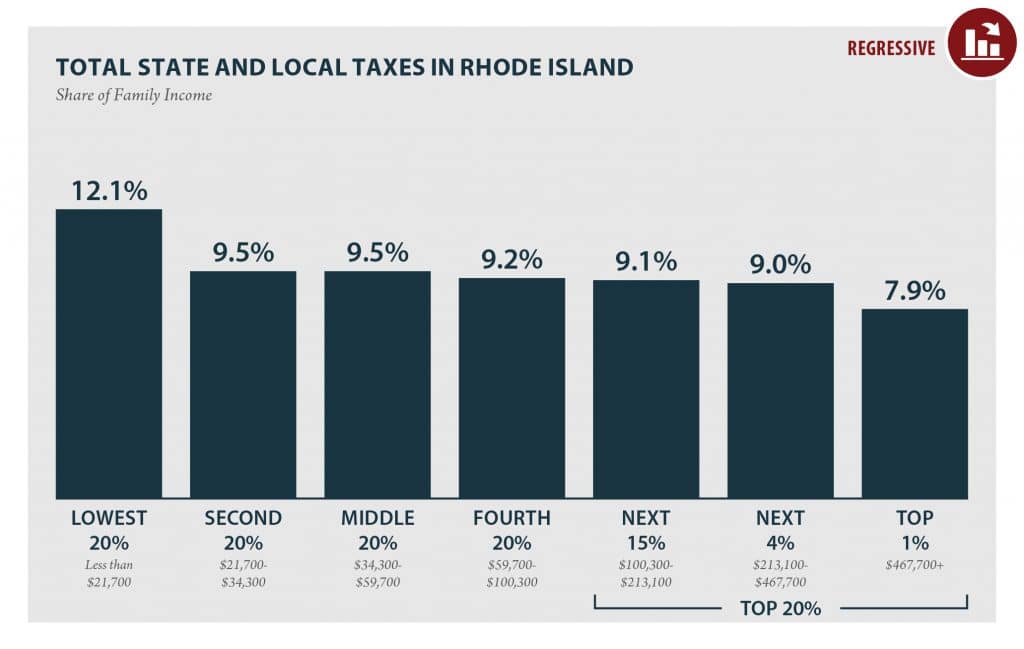

Low Income Taxpayers In Rhode Island Pay Over 50 Percent More In Taxes Than The Wealthiest

Liberty Talks Tax Rates And Green Fees Liberty Vindicator

State Individual Income Tax Rates And Brackets Tax Foundation

Map Of Rhode Island Property Tax Rates For All Towns

State Individual Income Tax Rates And Brackets Tax Foundation

39 Ri Real Estate Tax Rates By Town Ideas Estate Tax Rhode Island Towns

Seven Things To Know About The R I House Finance Budget The Boston Globe

Charlestown Commission Recommends Budget With Reduced Spending Level Tax Rate Charlestown Thewesterlysun Com